Unlock The Power Of Milliarde: Achieve Financial Success Through Strategic Planning is a comprehensive guide to achieving financial success through strategic planning that help you make right financial decision.

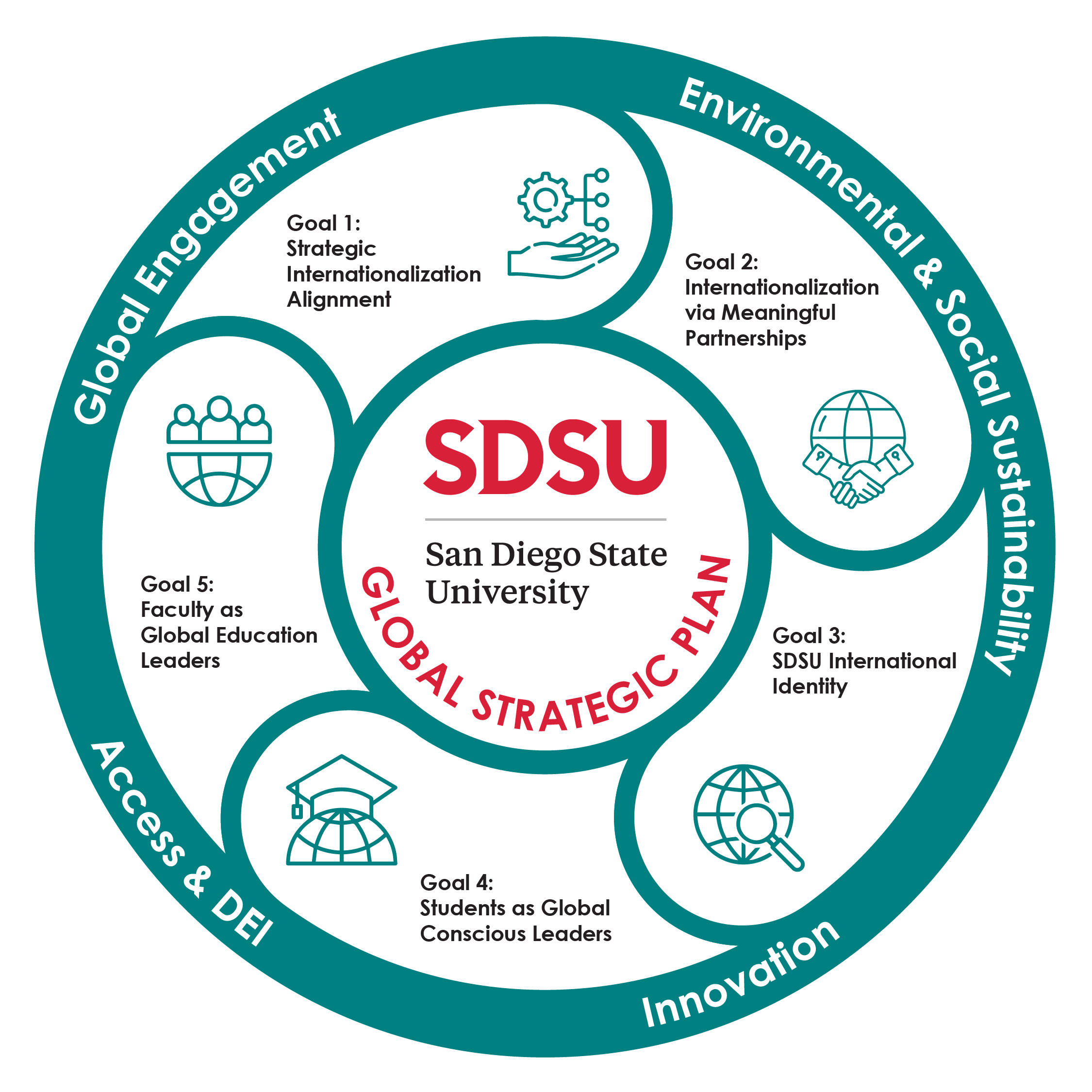

Plan & Process | International Affairs | SDSU - Source www.sdsu.edu

Editor's Notes: Unlock The Power Of Milliarde: Achieve Financial Success Through Strategic Planning have published today date. This topic is important to read because it provides a step-by-step framework for creating and implementing a strategic financial plan.

Through extensive analysis and research, we have compiled this guide to assist you in making informed financial decisions and achieving your long-term goals

Key takeaways from this guide include:

- The importance of setting financial goals

- Creating a budget and sticking to it

- Investing for the long term

- Protecting your assets

- Estate planning

Whether you are just starting out on your financial journey, or you are looking to take your finances to the next level, this guide has something to offer you.

FAQ: Unlock the Power of Milliarde

This comprehensive guide to strategic financial planning addresses essential questions and misconceptions surrounding the path to financial success.

Financial key success. Wealth solution to make money and get profit. A - Source www.vecteezy.com

Question 1: What is the core concept behind Milliarde?

Milliarde advocates for adopting a holistic approach to financial planning. It emphasizes the importance of integrating investment strategies, tax optimization, risk management, and succession planning to achieve long-term financial goals.

Question 2: How can Milliarde benefit individuals?

Milliarde empowers individuals with the knowledge and tools necessary to make informed financial decisions, maximize returns, and safeguard their assets. It provides a roadmap for navigating complex financial landscapes and achieving financial independence.

Question 3: Is Milliarde suitable for all financial situations?

While Milliarde provides valuable guidance for a wide range of financial circumstances, it is recommended to consult with a qualified financial advisor to tailor the strategies to specific needs and objectives.

Question 4: What is the significance of strategic planning in Milliarde?

Strategic planning forms the cornerstone of Milliarde. It involves defining financial goals, assessing risks, and developing a roadmap to achieve desired outcomes. Regular monitoring and adjustments ensure that the plan remains aligned with changing circumstances.

Question 5: How does Milliarde address investment risks?

Milliarde emphasizes the importance of risk management. It advocates for diversification, regular portfolio reviews, and the use of appropriate hedging strategies to mitigate potential losses and enhance returns.

Question 6: What is the ultimate goal of Milliarde?

Milliarde aims to empower individuals with the knowledge and confidence to achieve financial success, secure their financial future, and create a lasting legacy for themselves and their loved ones.

Unlocking the power of Milliarde requires commitment, discipline, and a proactive approach to financial management. By embracing strategic planning and adhering to sound financial principles, individuals can maximize their chances of achieving financial freedom and living a fulfilling life.

Discover more about Milliarde and its transformative impact on financial planning in the next article section.

Tips for Unlocking Financial Success

Strategic planning is essential for achieving financial success. It involves setting clear goals, identifying opportunities, developing strategies, and allocating resources effectively. By following proven tips, individuals and businesses can maximize their chances of reaching their financial objectives through a data-driven approach.

Tip 1: Establish Clear and Realistic Goals

Define specific, measurable, achievable, relevant, and time-bound (SMART) goals. This provides a roadmap for decision-making and allows for regular progress tracking. Avoid overly ambitious or vague goals that lack a clear path to achievement.

Tip 2: Conduct Thorough Market Research

Analyze market trends, target audience, and competition thoroughly. Identify industry-specific opportunities and challenges. This research will inform decision-making and help avoid costly mistakes. Unlock The Power Of Milliarde: Achieve Financial Success Through Strategic Planning

Tip 3: Develop a Comprehensive Strategy

Outline a detailed plan that outlines steps, timelines, and resources required to achieve goals. Consider various scenarios and develop contingency plans to mitigate risks. A well-crafted strategy provides a clear path forward.

Tip 4: Allocating Resources Wisely

Prioritize financial resources effectively by allocating funds to areas with the highest potential for return. Track expenses carefully and make adjustments as needed to ensure efficient use of capital.

Tip 5: Monitor Progress Regularly

Establish metrics to measure progress towards goals. Track results regularly and make adjustments to the plan as needed. Regular monitoring allows for timely course corrections and ensures alignment with changing market conditions.

By adhering to these tips, individuals and businesses can enhance their financial decision-making, allocate resources prudently, and increase their likelihood of achieving long-term financial success.

Unlock The Power Of Milliarde: Achieve Financial Success Through Strategic Planning

Navigating the financial labyrinth towards immense wealth, measured in "milliardes," requires a discerning approach. Embarking on this journey entails unlocking the power of strategic planning, encompassing six key aspects that serve as guiding principles for financial triumph.

- Goal Alignment: Synchronizing financial objectives with personal values and aspirations.

- Financial Discipline: Establishing prudent spending habits, fostering consistent savings, and minimizing unnecessary expenses.

- Investment Strategy: Diversifying investments across asset classes, balancing risk and return to maximize growth potential.

- Market Analysis: Assessing market trends, economic indicators, and industry dynamics to make informed investment decisions.

- Tax Optimization: Leveraging tax-advantaged accounts, maximizing deductions and credits to minimize tax liability.

- Estate Planning: Safeguarding wealth and ensuring its distribution according to personal wishes through wills, trusts, and other legal instruments.

Understanding the Wealth Playbook: Your Blueprint for Financial Success - Source georgebthompson.com

These aspects intertwine to form a comprehensive roadmap for financial success. Goal alignment provides a compass, guiding investment decisions that resonate with personal aspirations. Financial discipline serves as the foundation, ensuring the accumulation of wealth. Investment strategy harnesses market opportunities, while tax optimization amplifies growth. Market analysis empowers investors with knowledge to navigate market fluctuations. Finally, estate planning ensures a legacy of wealth distribution aligned with personal values.

Unlock The Power Of Milliarde: Achieve Financial Success Through Strategic Planning

The connection between "Unlock The Power Of Milliarde: Achieve Financial Success Through Strategic Planning" lies in the understanding that strategis planning is a critical component of financial success. Strategic planning involves setting clear goals, identifying the resources needed to achieve those goals, and developing a plan of action to reach them. By following a strategic plan, individuals and businesses can increase their chances of achieving their financial goals and objectives.

How to: Achieve Financial Success eBook | W A Lester - Source walester.com

For example, a business that wants to increase its sales can develop a strategic plan that includes goals such as increasing marketing spending, expanding into new markets, and improving customer service. The plan would also include a detailed action plan outlining the steps that need to be taken to achieve each goal. By following this strategic plan, the business can increase its chances of achieving its sales goals.

Strategic planning is also important for individuals who want to achieve financial success. Individuals can develop a personal strategic plan that includes goals such as saving for retirement, buying a house, or starting a business. The plan would also include a detailed action plan outlining the steps that need to be taken to achieve each goal. By following this strategic plan, individuals can increase their chances of achieving their financial goals and objectives.

Conclusion

In conclusion, strategic planning is a critical component of financial success. By following a strategic plan, individuals and businesses can increase their chances of achieving their financial goals and objectives. Strategic planning can help individuals and businesses to make better decisions, allocate resources more effectively, and track their progress towards their goals.

The key to successful strategic planning is to set realistic goals, develop a detailed plan of action, and track progress regularly. By following these steps, individuals and businesses can increase their chances of achieving their financial success.