DWS Group: A Leading Asset Manager for Sustainable Investments is a question that many people are asking these days. With the increasing focus on environmental, social, and governance (ESG) factors in investing, investors are looking for asset managers who can help them align their portfolios with their values.

Editor's Notes: "DWS Group: A Leading Asset Manager for Sustainable Investments" have published today date. This topic important to read because sustainable investing is a growing trend, and DWS Group is a leader in this area.

We have analyzed, dug information, made DWS Group: A Leading Asset Manager For Sustainable Investments we put together this DWS Group: A Leading Asset Manager For Sustainable Investments guide to help target audience make the right decision.

| Key Differences | Key Takeaways |

|---|---|

| DWS Group is a leading global asset manager with over €860 billion in assets under management. | DWS Group has a long history of investing in sustainable companies. |

| DWS Group offers a wide range of sustainable investment products. | DWS Group is committed to responsible investment practices. |

DWS Group is a leading asset manager for sustainable investments. The company has a long history of investing in sustainable companies, and offers a wide range of sustainable investment products. DWS Group is committed to responsible investment practices, and is a member of the United Nations Principles for Responsible Investment.

FAQs by "DWS Group: A Leading Asset Manager For Sustainable Investments"

Explore commonly asked questions and informative answers regarding DWS Group's approach to sustainable investments. This comprehensive FAQ section addresses key concerns and misconceptions, providing valuable insights into DWS Group's commitment to sustainability.

Sustainable Investments - Home - Source www.facebook.com

Question 1: What is DWS Group's definition of sustainable investing?

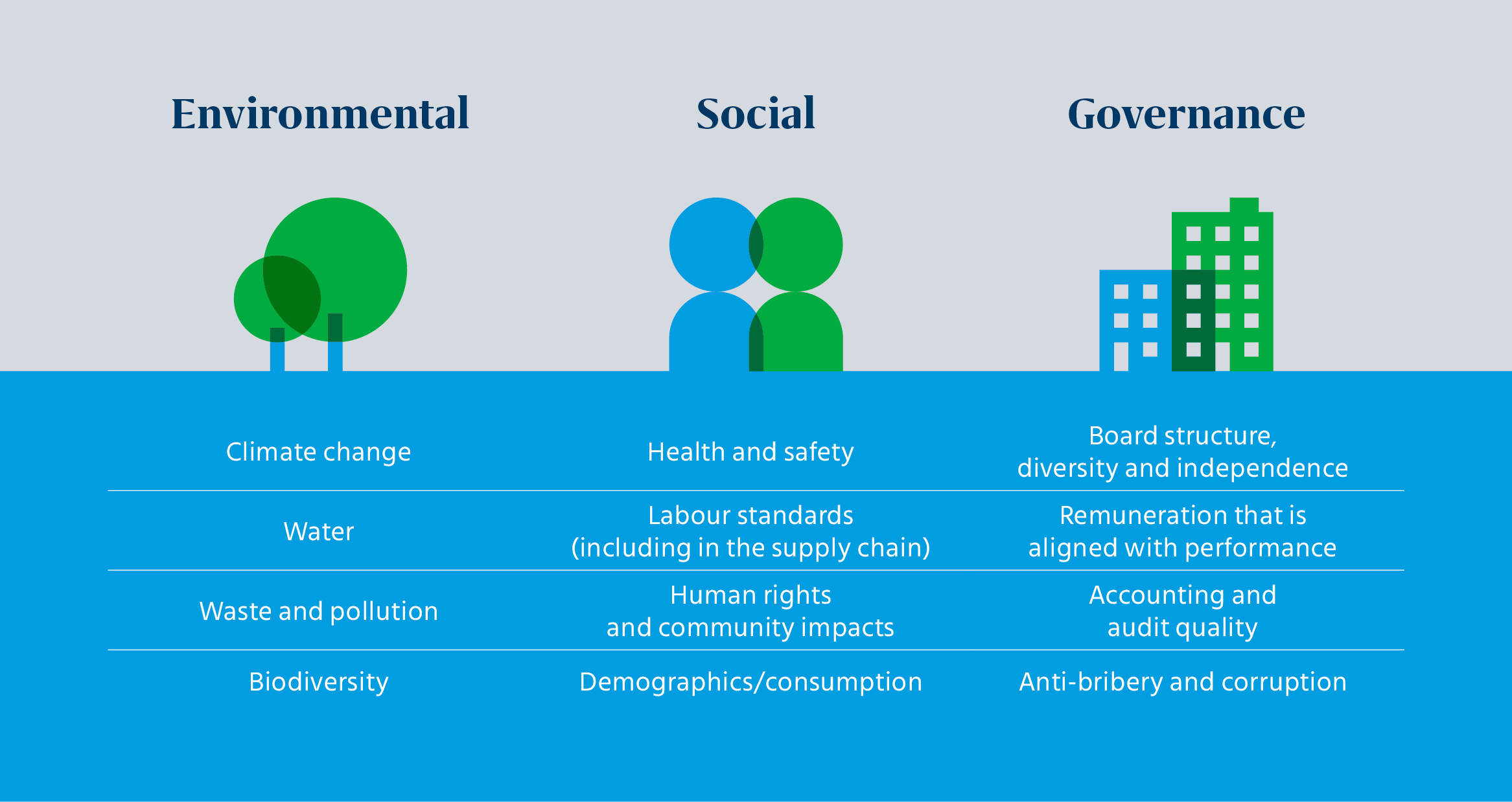

DWS Group defines sustainable investing as a holistic approach that incorporates environmental, social, and governance (ESG) factors into investment decisions. This approach aims to generate long-term value for investors while contributing positively to a sustainable future.

Question 2: How does DWS Group integrate ESG factors into its investment process?

DWS Group employs a systematic and rigorous ESG integration process that involves:

- ESG research and analysis to identify material ESG risks and opportunities

- ESG data collection and monitoring to track ESG performance

- Active ownership and engagement to influence companies' ESG practices

Question 3: What is the track record of DWS Group in sustainable investing?

DWS Group has a long-standing commitment to sustainability, with over 20 years of experience in ESG investing. The firm has consistently achieved strong investment results while maintaining a focus on sustainability.

Question 4: How does DWS Group address greenwashing concerns?

DWS Group recognizes the importance of transparency and accountability in sustainable investing. The firm adheres to industry best practices and is a signatory to the United Nations Principles for Responsible Investment (UNPRI). DWS Group also regularly reports on its ESG performance and engages with stakeholders to ensure alignment.

Question 5: What are the benefits of investing with DWS Group for sustainable outcomes?

By investing with DWS Group, investors can:

- Contribute to a more sustainable future

- Access a wide range of sustainable investment solutions

- Benefit from DWS Group's expertise and experience in ESG investing

Question 6: How can I learn more about DWS Group's sustainable investing approach?

Interested individuals can explore DWS Group's website, engage with the firm's sustainability team, or attend industry events where DWS Group experts share their insights on sustainable investing. The firm is dedicated to ongoing dialogue and collaboration to advance the field of sustainable investment.

In summary, DWS Group's commitment to sustainable investing is reflected in its comprehensive ESG integration process, track record of investment success, and commitment to transparency. By investing with DWS Group, investors can contribute to positive environmental and societal outcomes while seeking long-term financial returns.

Next Article: Exploring the Role of ESG Factors in Long-Term Investment Success

Tips by DWS Group: A Leading Asset Manager For Sustainable Investments

Sustainable investing incorporates environmental, social, and governance (ESG) factors into investment decisions to promote long-term value creation and positive societal impact.

DWS GROUP on Behance - Source www.behance.net

Tip 1: Define Your Goals:

Start by aligning your investment goals with your sustainability objectives. This will help you focus your strategy and measure progress.

Tip 2: Research Sustainable Investments:

Explore different sustainable investment options, such as ESG-focused funds, thematic ETFs, and green bonds. Consider their investment strategies, performance, and impact reporting.

Tip 3: Diversify Your Portfolio:

Spread your investments across multiple sustainable assets to reduce risk. This includes diversifying across regions, sectors, and investment types.

Tip 4: Engage with Companies:

As an investor, you can engage with companies to promote sustainable practices. Attend shareholder meetings, participate in dialogue, and support sustainability-focused resolutions.

Tip 5: Monitor Your Progress:

Regularly track the performance and impact of your sustainable investments. This will help you make adjustments and ensure your investments continue to align with your goals.

By following these tips, you can effectively integrate sustainability into your investment strategy and contribute to a more sustainable future.

DWS Group: A Leading Asset Manager For Sustainable Investments

In today's dynamic investment landscape, DWS Group stands out as a pioneer in sustainable investments. Through its unwavering commitment to environmental, social, and governance (ESG) principles, the asset manager drives positive change while delivering long-term value for investors.

Home - DWS - DALAT WORSTED SPINNING - Source www.suedwollegroup.com

- Investment Expertise: DWS Group's experienced professionals leverage in-depth market knowledge and rigorous research to create innovative investment solutions that align with ESG objectives.

- Sustainability Integration: ESG considerations are seamlessly woven into every aspect of the investment process, from stock selection to portfolio construction.

- Client-Centric Approach: The asset manager collaborates closely with clients to tailor investment strategies that meet their specific sustainability preferences and financial goals.

- Impact Measurement: DWS Group goes beyond ESG integration to actively track and measure the impact of its investments on sustainability metrics.

- Thought Leadership: The asset manager actively participates in industry initiatives and thought leadership forums, contributing to the advancement of sustainable investing practices.

- Global Reach: With a vast network spanning over 600 investment professionals in 22 countries, DWS Group provides investors with global reach and expertise.

These key aspects form the cornerstone of DWS Group's leadership in sustainable investments. By seamlessly integrating ESG principles into its investment philosophy and fostering collaboration with clients, the asset manager empowers investors to drive positive change while achieving competitive returns. DWS Group's commitment to responsible investing serves as a testament to its belief that sustainable investments can create long-term value for both portfolios and the planet.

Deutsche fund arm faces US probe over sustainable investments - Source www.rappler.com

DWS Group: A Leading Asset Manager For Sustainable Investments

DWS Group is a leading global asset manager with a focus on sustainable investing. The company has been a pioneer in the field of environmental, social, and governance (ESG) investing for over 20 years. DWS Group's commitment to sustainable investing is reflected in its investment process, which incorporates ESG factors into all investment decisions. The company also has a dedicated team of ESG analysts who research and evaluate potential investments. DWS Group's sustainable investing approach has been successful in generating long-term value for its clients. The company's ESG-focused funds have outperformed their benchmarks over the past five years.

Sustainable Investments - Source www.fity.club

DWS Group's focus on sustainable investing is driven by a belief that ESG factors are material to long-term investment returns. The company believes that companies that are well-managed from an ESG perspective are more likely to be successful over the long term. DWS Group's sustainable investing approach is also aligned with the increasing demand from investors for ESG-focused investments. Investors are increasingly looking to invest in companies that are committed to sustainability, and DWS Group is well-positioned to meet this demand.

DWS Group's sustainable investing approach is a key differentiator for the company. The company's commitment to ESG investing has helped it to attract clients who are looking for a long-term investment partner. DWS Group's sustainable investing approach is also a key factor in the company's success. The company's ESG-focused funds have outperformed their benchmarks over the past five years, and this outperformance is expected to continue in the future.

Table: Key Insights

| Insight | Description |

|---|---|

| ESG factors are material to long-term investment returns | Companies that are well-managed from an ESG perspective are more likely to be successful over the long term |

| There is increasing demand from investors for ESG-focused investments | Investors are increasingly looking to invest in companies that are committed to sustainability |

| DWS Group's sustainable investing approach is a key differentiator for the company | The company's commitment to ESG investing has helped it to attract clients who are looking for a long-term investment partner |

| DWS Group's sustainable investing approach is a key factor in the company's success | The company's ESG-focused funds have outperformed their benchmarks over the past five years |

Conclusion

DWS Group is a leading asset manager with a focus on sustainable investing. The company's commitment to ESG investing is reflected in its investment process, which incorporates ESG factors into all investment decisions. The company also has a dedicated team of ESG analysts who research and evaluate potential investments. DWS Group's sustainable investing approach has been successful in generating long-term value for its clients. The company's ESG-focused funds have outperformed their benchmarks over the past five years.

DWS Group's focus on sustainable investing is a key differentiator for the company. The company's commitment to ESG investing has helped it to attract clients who are looking for a long-term investment partner. DWS Group's sustainable investing approach is also a key factor in the company's success. The company's ESG-focused funds have outperformed their benchmarks over the past five years, and this outperformance is expected to continue in the future.