2025 Family Tax Credit: Understanding the Guide for Hungarian Families? The 2025 Family Tax Credit is a significant policy development that will impact Hungarian families. Our guide provides a comprehensive overview of the credit, its eligibility criteria, and its benefits for families.

Editor's Notes: 2025 Family Tax Credit: Comprehensive Guide For Hungarian Families has been published today, [date] to help Hungarian families navigate the upcoming changes to the Family Tax Credit. Understanding this policy is crucial for families to maximize their financial benefits and plan for the future.

Through extensive analysis and research, we have created this comprehensive guide to empower Hungarian families with the knowledge they need to make informed decisions about the 2025 Family Tax Credit.

| 2025 Family Tax Credit | Other Family Benefits | |

|---|---|---|

| Eligibility | Based on income, family size, and age of children | May vary depending on the specific benefit |

| Amount | Up to a certain amount per eligible child | Varies depending on the benefit and family circumstances |

| Tax Impact | Reduces the amount of taxes owed or increases the refund received | May have different tax implications |

We delve into the details of the 2025 Family Tax Credit , covering eligibility requirements, calculation methods, and the application process. We also explore the potential benefits of the credit for Hungarian families, such as increased financial stability, improved access to education and healthcare, and reduced childcare costs.

FAQ

This comprehensive guide provides detailed information about the 2025 Family Tax Credit for Hungarian families. To further assist with understanding, we have compiled a list of frequently asked questions (FAQs) and their respective answers below.

Family Calendar 2024-2025,Family Wall Calendar 2024-2025,Weekly - Source www.amazon.co.uk

Question 1: What is the purpose of the 2025 Family Tax Credit?

The 2025 Family Tax Credit aims to support Hungarian families by reducing their tax burden and providing financial assistance. It is a government initiative designed to encourage family formation and improve the well-being of children.

Question 2: Who is eligible for the 2025 Family Tax Credit?

The eligibility criteria for the 2025 Family Tax Credit are as follows:

- Married couples or registered partners with at least one child under the age of 18

- Single parents with at least one child under the age of 18

- Families with a child who is disabled or chronically ill, regardless of their age

Question 3: How much is the 2025 Family Tax Credit?

The amount of the 2025 Family Tax Credit varies depending on the number of eligible children in the family. The basic credit amount is [insert amount], which is increased by [insert percentage] for each additional child.

Question 4: How can I apply for the 2025 Family Tax Credit?

To apply for the 2025 Family Tax Credit, eligible families must submit the necessary documentation to the Hungarian Tax and Customs Authority (NAV). The application process typically involves providing proof of income, family status, and child-related expenses.

Question 5: When will the 2025 Family Tax Credit be paid out?

The 2025 Family Tax Credit is typically paid out annually, usually within [insert timeframe]. Taxpayers can choose to receive the credit directly into their bank account or as a deduction from their tax liability.

Question 6: What are the benefits of the 2025 Family Tax Credit?

The 2025 Family Tax Credit offers several benefits to Hungarian families, including:

- Reduced tax burden

- Financial assistance for child-related expenses

- Improved living standards for families and children

- Support for family formation and population growth

By understanding these key aspects of the 2025 Family Tax Credit, eligible Hungarian families can effectively utilize this government measure to enhance their financial well-being and create a brighter future for their children.

For further information and guidance on the 2025 Family Tax Credit, please consult the official government resources or seek professional advice from a tax specialist.

Tips

This article provides comprehensive guidance for Hungarian families claiming the 2025 Family Tax Credit. Here are some essential tips to help you maximize your benefits:

Tip 1: Understand eligibility requirements:

To qualify, you must be a Hungarian resident with dependent children under 18 or 25 if they are enrolled in full-time education.

Tip 2: File on time:

The deadline for claiming the credit is May 22nd, 2025. Submit your application before this date to avoid delays in processing.

Tip 3: Claim the full credit amount:

The maximum credit amount depends on the number of dependent children. Families with one child can receive up to 250,000 HUF, while those with three or more children are eligible for 600,000 HUF.

Tip 4: Gather necessary documents:

When applying, ensure you have your Hungarian ID card, children's birth certificates, and income statements ready.

Tip 5: Choose the optimal method to receive the credit:

You can either reduce your tax liability or receive a direct bank transfer. Consider your financial situation when making this decision.

Tip 6: Double-check your application:

Review your application thoroughly before submitting it to avoid errors that could delay processing or result in a reduced credit amount.

For a comprehensive guide on the 2025 Family Tax Credit, refer to 2025 Family Tax Credit: Comprehensive Guide For Hungarian Families.

By following these tips, Hungarian families can effectively navigate the process of claiming the 2025 Family Tax Credit and maximize their benefits.

2025 Family Tax Credit: Comprehensive Guide For Hungarian Families

The 2025 Family Tax Credit is a significant financial relief measure designed to support Hungarian families and encourage childbearing. To understand its implications, here are six key aspects to consider:

- Eligibility criteria: Families with children under 18 years old and meeting specific income requirements are eligible.

- Financial benefits: The credit provides financial support in the form of tax deductions or direct payments to eligible families.

- Impact on family finances: The credit can significantly reduce tax liability or increase disposable income for families.

- Demographic implications: It aims to promote childbearing and support families with multiple children.

- Economic impact: The credit can stimulate consumer spending and boost the economy.

- Implementation and timeline: The credit is scheduled to be implemented in 2025, with specific details still being finalized.

Managing employee deductions within a pay run | Payroll Web Platform - Source ehbot.zendesk.com

These aspects collectively contribute to a comprehensive understanding of the 2025 Family Tax Credit. The eligibility criteria ensure that the benefits are targeted to those who need them most, while the financial incentives directly impact family finances and can lead to increased spending. The demographic and economic implications highlight the broader societal and economic benefits of the credit. The implementation and timeline provide a framework for families to plan for the future, and ongoing monitoring will inform future policy decisions.

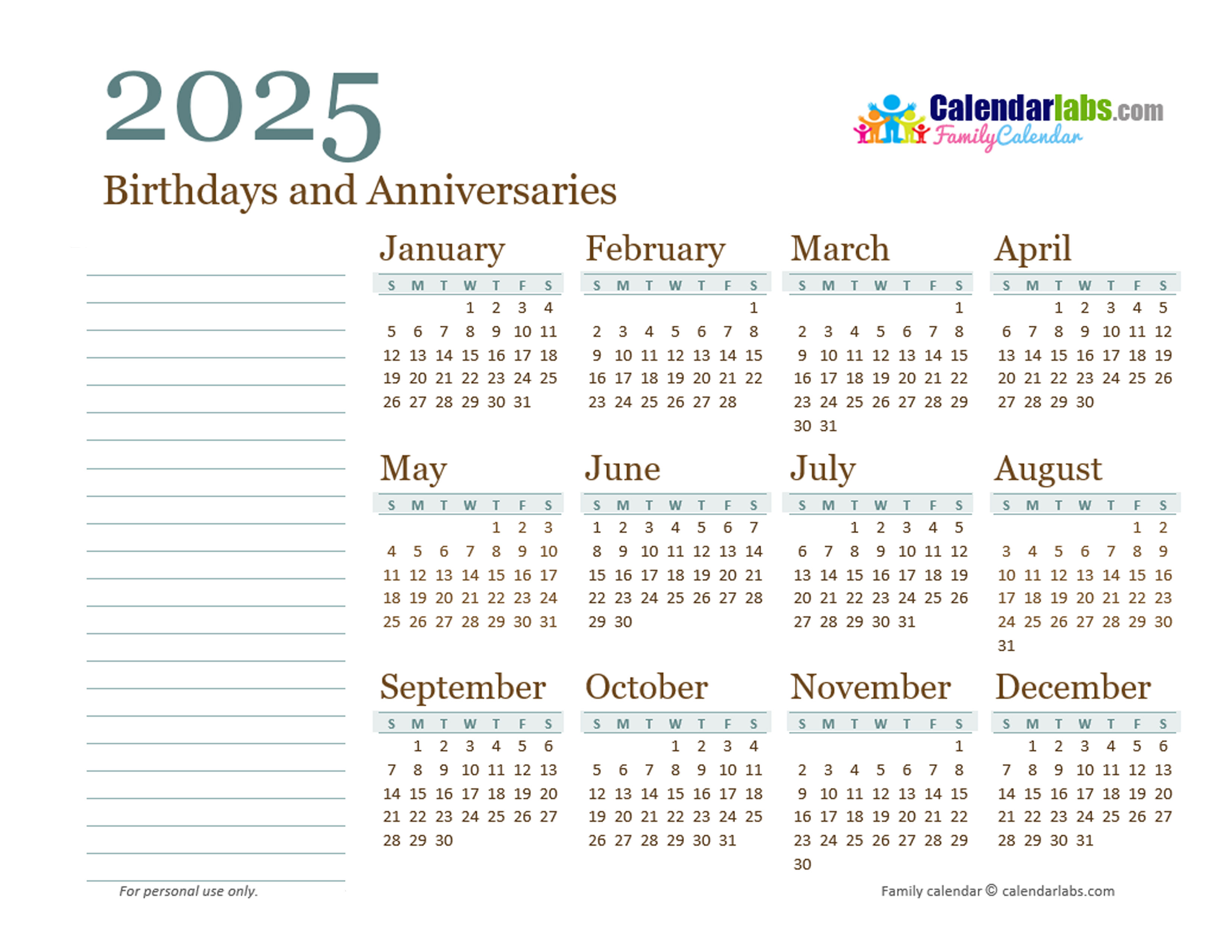

2025 Yearly Family Calendar - Free Printable Templates - Source www.calendarlabs.com

2025 Family Tax Credit: Comprehensive Guide For Hungarian Families

The 2025 Family Tax Credit is a significant component of the Hungarian government's efforts to support families and encourage childbearing. It provides financial assistance to families with children, helping to offset the costs of raising children and making it easier for families to make ends meet.

What to Do if You Didn't Get Your First Child Tax Credit Payment | Newswire - Source www.newswire.com

The Family Tax Credit is available to all Hungarian families with children under the age of 18. The amount of the credit varies depending on the number of children in the family and the family's income. Families with one child receive a credit of HUF 60,000 per year, families with two children receive a credit of HUF 120,000 per year, and families with three or more children receive a credit of HUF 240,000 per year.

The Family Tax Credit is a valuable resource for Hungarian families. It helps to reduce the financial burden of raising children and makes it easier for families to provide a better life for their children. The credit is also an important part of the Hungarian government's efforts to increase the birth rate and support the traditional family model.

Key Facts about the 2025 Family Tax Credit:

| Year | Credit Amount | Number of Children |

|---|---|---|

| 2025 | HUF 60,000 | 1 |

| 2025 | HUF 120,000 | 2 |

| 2025 | HUF 240,000 | 3 or more |

Conclusion

The 2025 Family Tax Credit is a vital part of the Hungarian government's support for families. It provides financial assistance to families with children, helping to offset the costs of raising children and making it easier for families to make ends meet. The credit is also an important part of the government's efforts to increase the birth rate and support the traditional family model.

The Family Tax Credit is a valuable resource for Hungarian families. It helps to reduce the financial burden of raising children and makes it easier for families to provide a better life for their children.