Our team has analyzed, dug into the information, and put together this guide to help our target audience make the right decisions regarding their retirement planning.

| Key Differences | Key Takeaways |

|---|---|

| 13th Month Pension is a supplemental pension payment made to retirees in addition to their regular pension benefits. | This extra payment can provide a significant boost to retirement income and help retirees maintain their standard of living. |

| 13th Month Pension is typically funded by employers as a way to reward employees for their long-term service. | It is not a government-mandated benefit, so not all employers offer it. |

| 13th Month Pension payments are usually made in a lump sum at the end of the year. | This can be a valuable source of extra cash for retirees to use for expenses such as travel, home repairs, or medical bills. |

FAQ

These frequently asked questions provide detailed information to guide understanding and decision-making regarding 13th Month Pension.

Centre approves Unified Pension Scheme: 23 lakh govt employees to - Source ddnews.gov.in

Question 1: What is the purpose of the 13th Month Pension?

The 13th Month Pension is an additional pension benefit designed to enhance retirement security and provide a stable income source during the non-earning years.

Question 2: Who is eligible for the 13th Month Pension?

To qualify, individuals must have completed the required years of service and made regular contributions to their pension plan.

Question 3: How is the 13th Month Pension calculated?

The benefit is typically calculated based on a percentage of the individual's final average earnings and years of service.

Question 4: When is the 13th Month Pension paid?

Payment timing varies depending on the plan's payment schedule, but it is generally disbursed annually.

Question 5: Can I withdraw the 13th Month Pension early?

Withdrawal options may be available, but they often incur penalties or tax implications. It is advisable to consider the long-term financial impact before making withdrawal decisions.

Question 6: What are the tax implications of the 13th Month Pension?

Pension income is subject to taxation, and the tax treatment may vary depending on the type of pension plan and tax laws in effect at the time of distribution.

Understanding these key aspects of the 13th Month Pension allows individuals to make informed decisions and plan effectively for a secure retirement.

Next, let's explore strategies for maximizing retirement income and building a robust retirement plan.

Tips

A 13th Month Pension: Essential Guide For Enhanced Retirement Security can provide a significant boost to retirement savings, enhancing financial security during the golden years. Here are some tips to consider for maximizing the benefits of this valuable retirement planning tool:

Tip 1: Understand the Basics

Familiarize yourself with the concept of a 13th Month Pension, including its purpose, eligibility criteria, and contribution limits. A clear understanding of the program's fundamentals will help you make informed decisions.

Tip 2: Explore Employer-Sponsored Plans

Many employers offer 13th Month Pension plans as part of their employee benefits packages. Check if your employer provides such a plan and inquire about eligibility requirements and contribution options.

Tip 3: Maximize Employer Contributions

If eligible, consider contributing the maximum allowed amount to your employer-sponsored 13th Month Pension plan. This will optimize the employer's matching contributions, increasing your retirement savings.

Tip 4: Consider Additional Contributions

In addition to employer contributions, you can make personal contributions to your 13th Month Pension plan. This allows you to further enhance your retirement savings and potentially reduce your tax liability.

Tip 5: Choose the Right Investment Options

13th Month Pension plans often offer a range of investment options. Carefully consider your risk tolerance, investment goals, and time horizon to select the most suitable options for your retirement savings.

Summary

By following these tips, you can leverage the benefits of a 13th Month Pension to build a stronger financial foundation for a secure retirement. Remember to consult with a financial advisor or retirement planning specialist for personalized guidance.

13th Month Pension: Essential Guide For Enhanced Retirement Security

The 13th month pension plays a pivotal role in fortifying retirement security. This comprehensive guide explores essential aspects to enhance retirement well-being.

- Supplemental Income: Provides an additional source of income during retirement.

- Financial Stability: Helps maintain a stable financial footing in the post-work phase.

- Inflation Protection: Counters the erosive effects of inflation on retirement savings.

- Security Blanket: Offers a safety net against unforeseen expenses or emergencies.

- Estate Planning: Can be incorporated into estate planning strategies.

- Employer Contribution: Encourages employer participation, fostering a culture of retirement preparedness.

These key aspects illustrate the significance of the 13th month pension in ensuring a financially secure retirement. By providing an additional income stream, safeguarding against financial vulnerabilities, and supporting long-term planning, it serves as a cornerstone of retirement security.

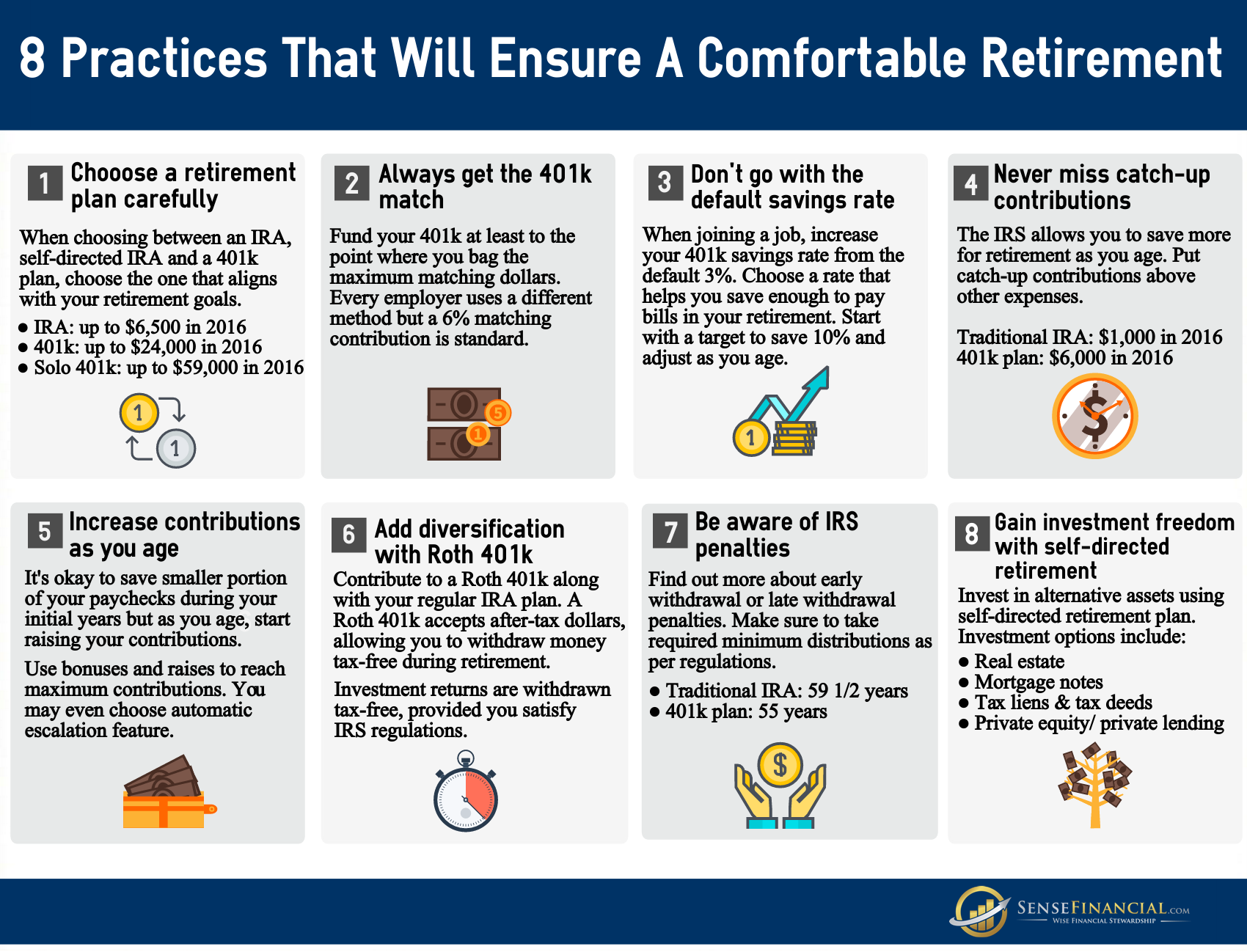

Infographic: 8 Retirement tips that will ensure a comfortable retirement - Source www.sensefinancial.com

13th Month Pension: Essential Guide For Enhanced Retirement Security

Pension plans play a crucial role in ensuring financial security during retirement. Among these, the 13th-month pension holds particular significance as it provides an additional monthly benefit beyond the standard 12 monthly payments. This guide explores the intricacies of 13th-month pension schemes, their impact on retirement planning, and strategies for maximizing their benefits.

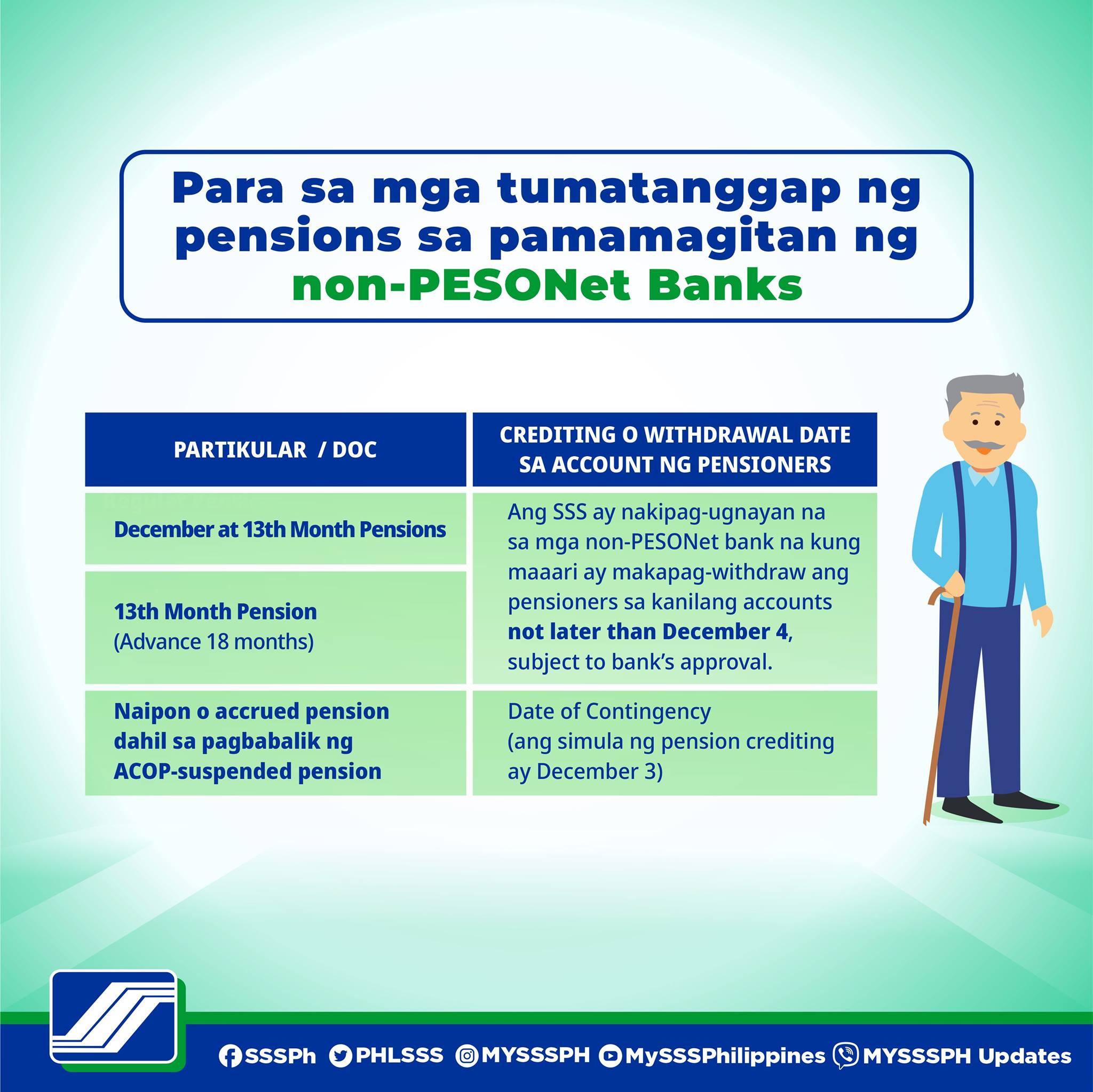

SSS Pension Release Schedule for December and 13th month 2020 - SSS - Source sssinquiries.com

The 13th-month pension emerged as a means to enhance retirement savings, offering a significant boost to post-retirement income. Compared to traditional pension plans, it not only increases the monthly pension amount but also addresses the issue of inflation by providing an annual lump sum adjustment. This adjustment helps preserve the purchasing power of the pension over time, ensuring a more comfortable retirement lifestyle.

Understanding the factors influencing the 13th-month pension is essential for effective retirement planning. Factors such as eligibility criteria, contribution rates, and vesting schedules can vary depending on the specific pension scheme. Additionally, maximizing the benefits requires a proactive approach. Regular monitoring of the scheme's performance, exploring investment options, and seeking expert advice can help optimize the returns on 13th-month pension investments.

The 13th-month pension serves as a valuable tool for enhancing retirement security, providing a financial cushion during the golden years. By understanding its intricacies, individuals can make informed decisions and leverage its benefits to secure a comfortable and fulfilling retirement.

Conclusion

The 13th-month pension stands as a cornerstone of comprehensive retirement planning, offering a substantial boost to retirement income and safeguarding against inflation. Its impact on retirement security cannot be overstated, providing individuals with the means to maintain a comfortable lifestyle during their later years.

Recognizing the significance of this benefit, individuals are encouraged to actively engage with their pension plans, understand the factors affecting their 13th-month pension, and adopt strategies to maximize its potential. By doing so, they can create a solid financial foundation for a secure and fulfilling retirement.